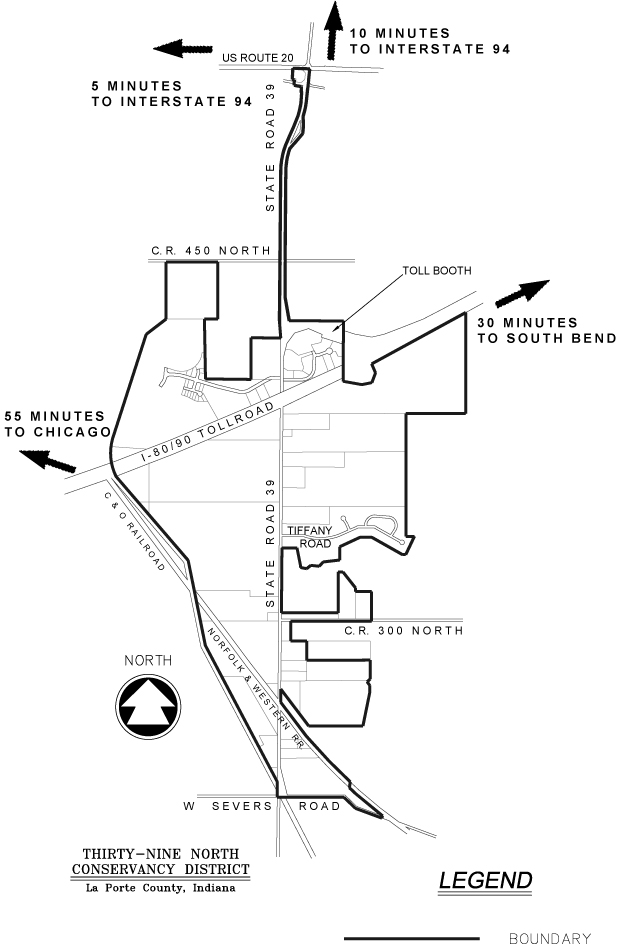

The 39 North Conservancy District was created to bring water and sewer to the property owners on both sides of State Road 39, from the north side of the City of La Porte to just beyond the Indiana Toll Road.

Construction began in 1997 with the majority of financing provided through a twenty (20) year bond, which, we are proud to announce, is paid off.

Water and sewer provided by agreement with the City of La Porte's facilities is of enormous benefit for the residents, businesses and industries within the conservancy district. Prior to sewer and water installation by the District, the problems associated with well water (hardness, iron and chemical impurities) and the limitations of septic systems made commercial and industrial development almost impossible.

Since the system became operational in 1999, the 39 North Conservancy District has provided clean water and reliable services to all its customers.

Call us at 219-362-3390 for more information.